****1 November 17:30 ADT - Updated with Petra, apologies for the resend****

Since Cettire were presenting at the Evans conference on Wednesday their disclosure runway had expired meaning we FINALLY got to see how their 20% growth trumpeted at the FY results actually translated into numbers - and oh my. Oh dear.

Given the results were so pitiful, the run rate so slow and in the absence of a handy bunny (sorry about that), the best Cettire could come up with was an exit rate EBITDA margin of 5%, suggestive of green shoots!

However they also said they were managing the business for profit, and with such a short period they could engineer an exit rate EBITDA of whatever they want simply by paying the gas bill a bit later, presuming they haven’t already capitalised it.

The terminally optimistic might try to take the growth rate from the beginning of October and multiply it by the EBITDA margin at the end of September - but surely this cynical exercise is too obviously educationally subnormal for all but Julian.

Assessing sustainability of 5% EBITDA margins

The inescapable conclusion from this update is that delivered margins are now terminally impaired. As a reminder, delivered margin is the amount left for Cettire after they’ve delivered the item to the end customer, and from this Cettire need to fund:

Merchant costs of around 4% of sales

G&A of around 4% of sales

Marketing costs which have historically averaged around 10% of sales

Before we get to the EBITDA number.

With an exit EBITDA margin of 5%, the only number they had an ability to flex was marketing.

Taking Cettire’s delivered margin of 17%, to generate an EBITDA margin of 5% with merchant and G&A of 8%, on an ongoing basis they would have 17-8-5 = 4% of sales to spend on marketing. This is not sustainable.

Marketing spend is crucial

Even if Cettire managed to maintain their Q2 sales figures - which the CFO seemed to think would be a great result - then that would give CTT $9m to spend on marketing.

As a reminder, Customer Acquisition Cost (CAC) was running at around $145 in 2H24, which would translate to gross customer adds of ~65k. With a starting figure of ~700k active customers and a quarterly churn rate around the 10-15% mark, that would translate to gross customer losses of 70k-105k and net active customer reductions.

It’s impossible to see a path to customer growth with a 4% marketing spend, even in Cettire’s biggest sales quarter meaning that in absolute terms their marketing spend would be at its highest.

Soundbites as Strategy (Here you go create another fable)

Perhaps the most worrying implication of Cettire’s presentation of results is that they are managing the business through different periods of the quarter to produce the numbers they then selectively quote.

Oh it’s August? Let’s go for growth so we can be upbeat at the FY results! Look!!! 20% growth baby!

It’s September and the Q1 results are due soon and oh noes, we’re loss making because we’ve had to spend money on marketing to grow! Quick! Turn off the marketing spend spigot! Look! 5% EBITDA margin baby!

This is no way to run a business and no way to present your results to market. The fact remains that EBITDA margins were 1.3% over the quarter - there is no exit rate. There’s only a delivered margin that is impaired even despite ramping up charges for returns since they can no longer charge duties as a separate line item and then pocket it, which it is now clear was their entire margin.

Bell Potter - Chami takes the bait but still too expensive

Bells cut their rating to hold on despite viewing adjusted EBITDA margin of 5% as “healthy”. Chami calls for 3.7% EBITDA margins in 2Q - presumably on the back of continued marketing underinvestment.

Everything’s a miss but still strong and healthy apparently:

But just too expensive, so down to hold.

RBC - Wei Weng gets it

RBC cut their rating to underperform pointing out that irrespective of the structural vs cyclical ‘argument’, the luxury super-cycle has ended.

Perhaps most importantly for Cettire, brands are using the downturn to consolidate their sales channels - away from the wholesalers on which CTT depends, knocking out another leg on which the bull thesis depends.

Evans and Partners - Juliaaaaan continues to really not get it

Julian swallowed the line harder than he ever had before, with a note titled “Focus on the improving glide path”. The glide path is into a hillside Julian.

Indeed Julian reckons that it was the delivered margin that changed through the quarter:

This begs the question why Cettire would have cut their commission by 10% from peak DM of 25% whilst wholesalers who have to finance the inventory took zero pain?

Or maybe they just had terrible delivered margins without duties revenue and then flexed down marketing spend in September to fool the willingly credulous?

Barrenjoey - Ari seemed to start to get it but has now lost it

Ari seems to be done with this since in order to stay on neutral, various logical and fiscal gymnastics were required to get his price target up into the hold range, including increasing FY32 (!) EBITDA margin to 7.5% because… Well he wants to stay on hold presumably.

Ari has suffered enough, it would be churlish to be too critical of this nonsense.

Post script: Petra - Sam sees improved governance but hacks back earnings

Whatever the superficial improvements in governance, they haven’t changed the behaviour of selective disclosure, so I’m not sure I can go for that.

Cettire appointed scion of John ‘Pig’s arse’ Elliott, Caroline Elliott to the board whose listed board experience to date includes bus and ferry company Kelsian (KLS) since June this year, and prior to that 6.5 years on the board of serial capital raiser and apparent lifestyle company DorsaVi (DVL). This in addition to Jon Gidney whose storied investment banking career also included a stint advising Blue Sky Asset Management on how to deal with short sellers, which ended with BLA in liquidation. From all accounts Gidney was brought on to ‘deal with the shorts’, and three solid short squeezes later - including one engineered with the founder’s own money - we’re back sub $1.50, which doesn’t seem to have been a great use of $16m of the founder’s own cash money, but what people will do to enter the magic circle of ASX non-executive directors is up to them.

Sam also appears to be buying the “Grant Thornton signed off on duties treatment” - which is not what happened, as previously noted - but earnings are hacked back anyway, and with very low certainty as to his 4% EBITDA margin forecast.

EBITDA is not profit, especially not adjusted EBITDA when Cettire is adjusting it (Hide the scars to fade away the shake-up)

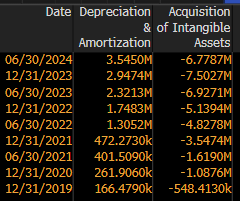

Cettire are notorious for many things, but amongst them is capitalising everything in sight. When things are capitalised, they contribute to depreciation but not to EBITDA. However with Cettire, the “investments” into intangibles outrun the depreciation charge by a factor of 3x since listing - $37.4m of capitalisation vs $13m of depreciation.

In FY24 alone, Cettire capitalised $14.3m of intangibles and had a D&A charge of just $6.5m.

Perhaps Regal might like to reassess the materiality of this from their prior comments:

Obviously CTT isn’t a tech company, but leaving that aside in 2H24 Cettire had operating cashflow of -$2m (along with -$10m from buying up stock around $3.80 to pay operating expenses of SBC!). It gained a $3.2m accounting benefit from capitalisation compared to pre-tax losses of -$2.3m.

The capitalisation is absolutely material.

An analogue: 1Q23

In order to eliminate seasonality, refund rates and marketing spend as variables, we only need look back to the last time Cettire found themselves in a tight spot - after the disastrous FY22 result.

During FY22 Cettire spent up big on marketing and offered free returns, resulting in a returns/refund rate of >27% and a marketing spend of 21% of revenues, leading inevitably to a FY operating margin of -12% and a loss of -$26m.

After this, Cettire amended their “operating settings” and implemented “cost optimisation initiatives”. These included charging for returns, keeping any ‘duties’ paid by the customer and massively reducing advertising spend. Sounds familiar!

In FY23 this resulted in delivered margin of 25%, which flowed down the income statement to an EBITDA margin of 8.3%, and cash increased from the prior quarter.

In FY25, despite 143% more active customers spending 8% more on average, with revenues 134% higher - and with the same return/refund rate and the same spending rate on advertising - delivered margin fell over 8% resulting in a -64% drop in EBITDA.

Operating leverage this is not, and this deleverage is certainly coincident with the duties and returns policies having to change and the scrutiny on sales taxes in the US. Structural, cyclical - even super-cyclical to take Wei Weng’s thesis - it’s still pretty clear that margins and cash generation have not survived.

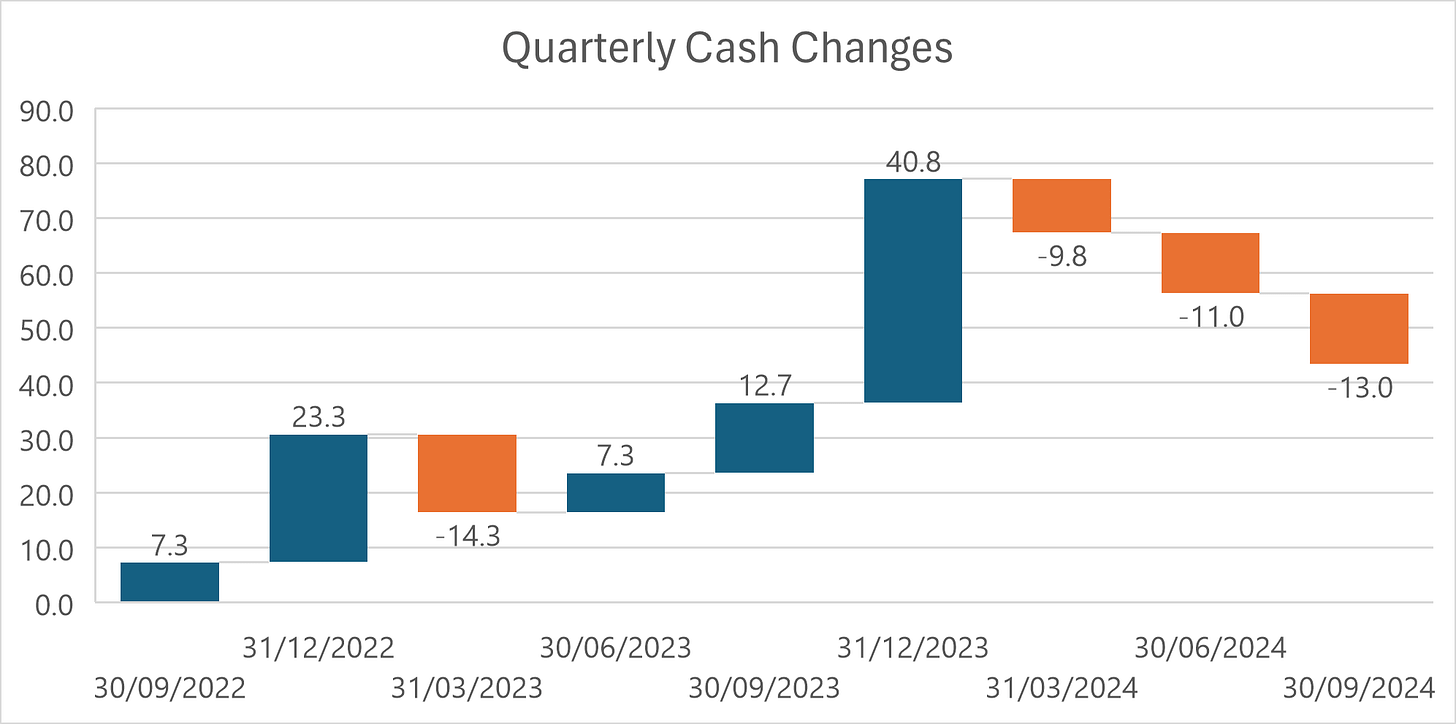

Indeed after posting cash increases in 5 of the last six quarters (if we fudge the 3Q23 where they provided a 4 month number), Cettire have now recorded 3 consecutive quarters of cash declines post the duties and sales tax ‘scrutiny’.

Since we’re now in Q2 which is Cettire’s money maker, we should be expecting a ginormous cash build. Right? Well there had better be since Q3 is their seasonal cash outflow and now Q4 and Q1 are too…

So what are we left with?

Well we’re left with a company that can’t simultaneously grow and make profits. It can barely make profits any more without duties revenues despite hiking returns fees to the moon.

We’re left with a company that can’t increase the sales commission it charges to its wholesale suppliers because the reason the suppliers sell through Cettire is because they charge less than its competitors like Farfetch.

We’re left with a company that can’t increase its prices to its end customers because the only reason people shop with Cettire is because they are cheaper than Farfetch and the brands direct. Erode that and sales drop to zero.

We’re left with a company that it still dependent on the de minimis exemption to generate its pricing advantage in the US, and the de minimis is at risk whilst despite Grant Thornton’s apparent clean bill of health, they aren’t entitled to use FSFE and de minimis simultaneously as they did with our coat.

We’re left with a company that is following the trajectory of Farfetch with around a three year lag.