Under section 250T of the Corporations Act, the chair has to allow shareholders the opportunity to ask questions of the Auditor in relation to their conduct of the audit.

Under section 250PA, the auditor has to answer questions submitted in good time under penalty of strict liability.

Unfortunately good time appears to have been the 7th of November, but I’m sure that a diligent auditor and chair committed to openness will accept questions irrespective, especially since the auditor has had the questions for months already.

Why the questions matter

Well the market has interpreted the audit report as a clean bill of health for Cettire - and made investment decisions on the back of it.

Quite apart from the 79% rally on the day of the audit, the materiality can be seen from the commentary from analysts and shareholders on the audit report:

Petra:

CTT’s auditor undertook an extensive review of the company’s accounts, including the calculation and treatment of customs duties and import taxes, and concluded all was reasonable and in line with the relevant laws and regulations of the relevant countries.

We believe these developments have strengthened CTT’s corporate governance and risk parameters, and therefore warrants a review of our model risk parameters.

Barrenjoey:

4) Release of audited accounts in Sep has de-risked the investment proposition following more rigorous audit in areas like Customs Duty and Import Taxes;

Our WACC falls from 13% to 11% to reflect the release of CTT’s audit statement which has de-risked the investment proposition. We note, our WACC increased to 13% following CTT’s FY24 results in August which were unaudited.

and most succinctly Regal:

The second catalyst was the release of Cettire's audited financial accounts which dispelled the bear thesis on duties.

Multiple questions in two parts

For the purposes of this post, I’m going to break the questions down into two parts with a bit of explanation for the reader. The auditor will presumably require no such priming.

Duties

The audit report identified Customs duty and import taxes as a key audit matter under note 12 of the accounts (this is somewhat key):

Note 12 refers to "Trade and other payables". However customs revenues were err… revenues, and customs costs were part of fulfilment costs under SG&A. This suggests the review was to determine if there was a liability that required disclosure under the relevant accounting standards.

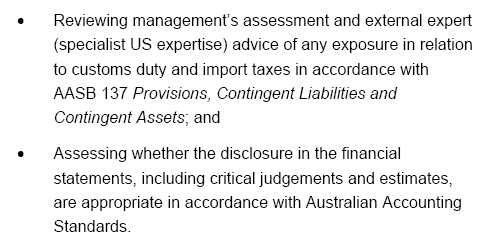

The procedures adopted appear to confirm this:

Since our focus has been on US customs compliance, we can limit our interest for the rest of this piece to the market where they derive most of their revenue.

The “management’s expert advice” clearly relates to the use of First Sale For Export (FSFE) rules to reduce the customs duties payable for import purposes.

If we accept that the use of FSFE is valid, have you confirmed that it can only serve to reduce the liability to duties but not to remove it, since the de minimis exemption under Section 321 applies to goods whose fair retail value is USD800? If the item has been sold to the customer for over USD800, then the fair retail value has been established as over $800 so section 321 does not apply. Does this accord with the advice you have received from your internal and external experts?

How was the sample of sales transactions for vouching selected?

Was it provided by the company or was it a sample selected by the auditor to maximise the probability of catching any malfeasance?

Were the transactions selected US based and over USD800?

What proportion and number of the transactions selected had US end customers and items over USD800 included?

What processes were undertaken to verify the HS codes declared to US customs vs the duties revenue charged to customers for items over $800?

What processes were undertaken to verify HS codes declared by Cettire to customs vs high duties/high value items such as wool jackets for items over $800?

In the revenue recognition key audit matter Grant Thornton used data analytics to risk profile transactions. What risk profiling was undertaken to identify high risk transactions for US customs fraud?

AASB 137/IAS 37

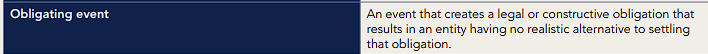

Over to Grant Thornton for a summary of how the relevant standard works:

Have Grant Thornton assessed that there is a present or possible "obligating event"?

If not, why not?

If there is a present or obligating event, what made Grant Thornton decide that the probability of an outflow was remote?

All the other good stuff Grant Thornton didn’t address in KAMs

ASA 200: Professional scepticism:

What investigations were undertaken to determine if customer invoices had been edited?

In the invoices we identified to you, what was changed?

What investigations were undertaken to determine if HS codes and resulting duties had been differentially quoted to customers and CBP?

Revenue Recognition:

The company said not a single Cettire employee had anything to do with shipping the product to the end customer or managing returns. How does the company take control of the goods as required by the standard?

Accounting discrepancies:

Contract liabilities (the revenue not yet earned due to the product not yet being delivered) and Inventory (the cost of goods sold for product sold but not yet delivered) has differed by precisely 35.20000%. If the auditor is aware that this is a plug figure, is the contract liabilities figure or the inventory figure the number on which the other is based?

What processes were undertaken to verify the independent number?

What processes were undertaken to verify the assumption of the difference?

Since the ratio represents the product margin on the goods in transit and the company claims that the product margin reduced significantly towards year end, how has this ratio been verified?

Sales taxes:

What is the invoicing entity for Cettire's sales into the US?

If it's Ark International, why do the invoices show Ark Technologies?

If it's Ark Technologies, why isn't Ark Technologies registered for sales taxes in the US states in which it has nexus?

Deed of Cross Guarantee for Ark International:

Ark International was not party to the deed of cross guarantee for FY23. Grant Thornton was the auditor. On what basis did GT not perform an audit for Ark International for FY23?

What responsibilities does an auditor have to identify which subsidiaries of a company require their own audit?

R&D Incentive:

Do Cettire possess an Advance Overseas Finding for their R&D expenditure?

What proportion of Cettire's claimed R&D incentive eligible expenditure is undertaken in Australia?

Why answer the questions?

They were asked of the auditor before the audit. And I’m a concerned shareholder (or at least a proxy for one).

If Cettire would like to take an open mic, I’ll be there!