Programming note

Do not adjust your sets. For those who only follow these pixels for stellar analysis and withering snark on Cettire - you can skip this one. For those who share a broader interest in the market - this one is about WA1, a nascent Niobium superpower. Normal programming will be resumed imminently.

The Luni project - it is whatever you say it is

WA1 has had a stellar run over the last year, from mid $4 to a last price of $20.69 for a market cap of $1,269m - a run based on what by all accounts and today’s share price reaction is a fantastic resource with decent metallurgy, bearing comparisons with the Araxá mine in Brazil owned by privately held CBMM, which dominates the ~100ktpa, US$4.5bn pa Niobium market with a ~80-85% market share. Luni even been called a ‘Tier zero’ asset on the bird app by those who make a living from hyperbole. It’s beyond the scope of this quick note to examine the assumptions made for grade, recoveries, processing costs and all the other good stuff that turns a resource into a reserve into a mine - so for the purposes of this post, let’s just assume all these factors are as good as the bulls say, it matters little.

The whale in a puddle

So having cast a cursory glance over the project itself, the next question becomes can pricing be held constant at levels maintained by what the bulls concede is a highly concentrated, monopolistic market - even despite that market transitioning to becoming more competitive upon the entrance of a new, low cost player?

Ferro-niobium pricing has been remarkably stable over the past five years, trading between US$25-30/kg once adjusted for VAT - as one might expect in a monopoly supplied market.

The brokers that cover WA1 also have remarkably consistent assumptions. They estimate that Luni could produce around 22ktpa of ferro-niobium - meaning that absent new demand this is the amount of global production - over 20% around 15%1 of current production - that would need to be displaced in order to accommodate WA1’s product. All three brokers also use a flat $45/kg contained Nb pricing assumption, which is $29.3/kg for Ferro-nickel - so the spot price.

Dusting off our economics 101, we should know that in a competitive market the amount produced and pricing is set by marginal buyers and suppliers. Niobium’s use as a trace additive in steel making means demand is set by the ~USD1,700bn pa steel market. This renders demand for FeNb relatively constant relative to the steel market meaning that buyers are both relatively insensitive to pricing for the poofteenth of Nb they need to add to their steel, both on the upside and the downside.

Whose product will be displaced and at what price?

So where will this supply be removed from? The obvious place to look is firstly in other developments that would not proceed if the Tier Zero project does, then subsequently at the two other major producers in the market, CMOC and MPM.

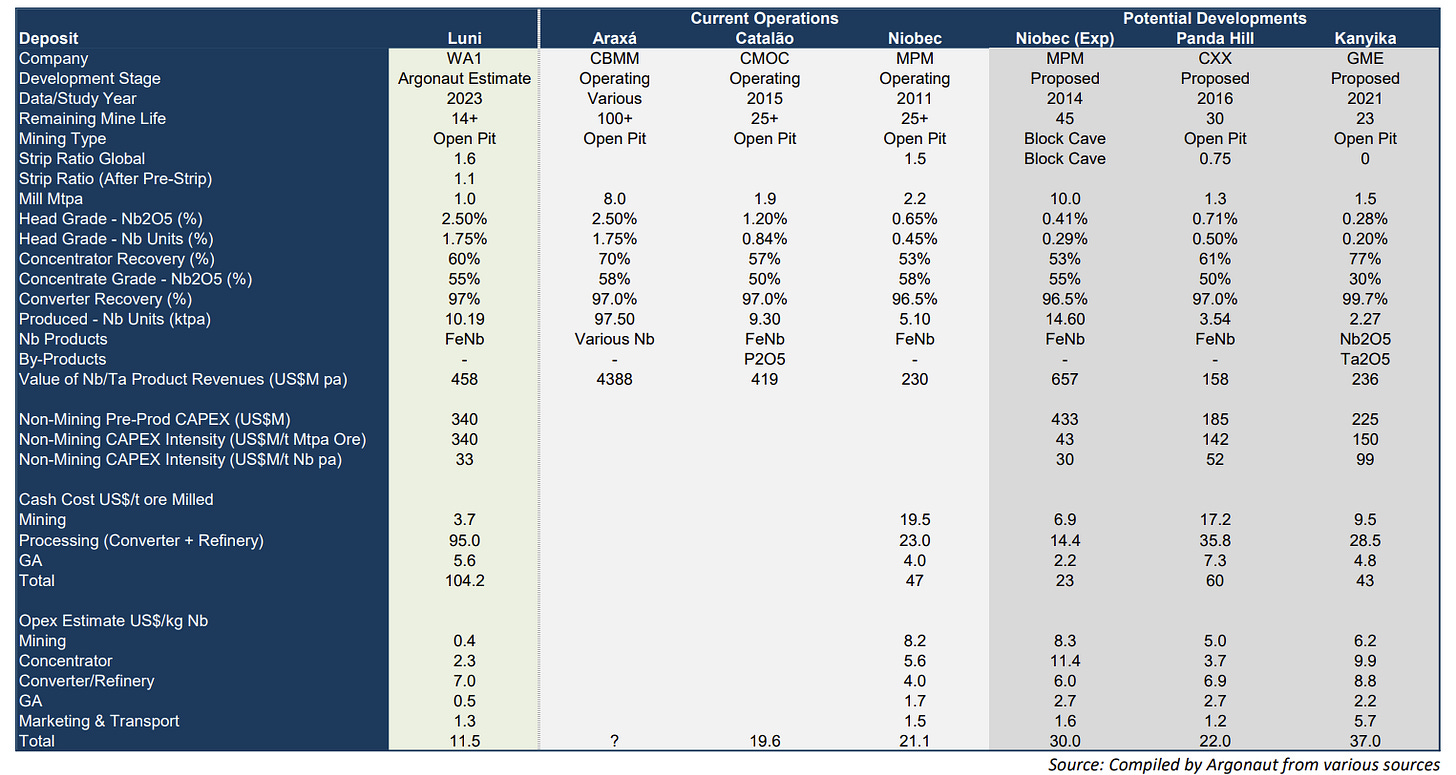

Argonaut helpfully provided a list of these projects along with opex estimates.

CMOC has a C1 cost here of $19.6/kg Nb, and MPM has a $21.1/kg cost. Simple economics dictates that as these companies have already spent their capex, they will continue to produce Niobium until they start to lose money doing so. This means that to displace CMOC and MPM accounting for between 15-18% of the global market, prices would need to drop to below $19.6/kg - a ~56% fall from the spot price and broker model assumptions.

Using Argonaut’s estimate of C1 costs of $11.5/kg for WA1, this would reduce their gross margin by ~76%, effectively wiping out any profit from the mine once sustaining costs are taken into account.

This is before even considering the response of the dominant player CBMM, whose Araxá mine’s remaining life of 100+ years suggests that they have optimised their operation’s size to the market rather to maximising production. We don’t have an estimate for their cash costs, but crucially - they already have the mine built. They don’t have to spend the ~$700m estimated capex the WA1 do in order to produce, all the work has been done and depreciated. At any given price, they would have the advantage of incumbency and sunk costs and could keep producing at prices close to their marginal cost of production - which if we guesstimate is the same as WA1’s here, wipes out any reason to spend the capital on Luni in the first place.

Quintis and Syrah analogies

As Quintis discovered with Indian Sandalwood and Syrah discovered with graphite when your production capacity is a large fraction of the global market for the product, the market changes. This is not the iron ore, copper, nickel or even manganese market, it’s a tiny $4.5bn/yr and that’s at monopoly prices. If WA1’s resource is as good as everyone says it is - and if it is then management are to be congratulated on it as are the people who have ridden this up - then ironically the Niobium market is screwed as are all the players in it.

In any case - the assumption that spot pricing can be maintained when over 20% is added to global supply at the very minimum bears further scrutiny.

Thanks to the highly civilized jcymck on twitter for pointing out I’d mixed up ferro-niobium with pure niobium. Threads here:

https://x.com/jcmyck/status/1803634376946884719 and here https://x.com/taxlosstrades/status/1803644658800795856

Shooting from the hip here but on the basis of some concentrate numbers I saw for WA1 then the Ta205 value contained in ore could exceed the Nb2O5 value. Not sure on current prices, but I guess Ta2O5 in concentrate is worth about US$150/kg cf US$35 for Nb2O5. So the project is not just a pure play niobium project. From Greenbushes days, niobium was just a pest in recovering 99.99% Ta2O5 product in the on site SX plant, specifically developed for the job.