Wilsons Income Maximiser: maximising income for... Wilsons?

If your adviser recommends this, get a new adviser

Wilson Asset Management are launching a new product! And boy is it innovative. Only kidding, it’s a 60/40 fund, only this time with franking. WAM aren’t renowned as a bond fund manager, but they do claim that they are good at equities. But are they?

That’s half a billion lads

The fund is raising $510m at $1.50 per share, paying advisers 1.25% (plus GST) as a commission for selling it.

[erratum - WAM are paying the commissions not the fund]

For the privilege of getting in on this hot IPO, WAM will pay your adviser a commission which on raising $510m, would amount to $9m (plus gst of course)

Why would WAM cover this cost, and what justification would an adviser have for receiving this commission?

For WAM, it has to be that they want the captive capital to charge fees on, but for the adviser, surely they must believe that WAM provide superior investment performance?

Well if they do, they must have developed this ability very recently since the track record of their listed funds is utterly garbage.

WAR? What it is good for (absolutely nothing)

In WAM’s “strategic value” fund’s prospectus, they warned that

Compensation fee structure risk: The Investment Manager may receive compensation based on the Portfolio’s performance. The Performance Fee may create an incentive for the Investment Manager to make investments that are more speculative or higher risk than would be the case. There is no ‘hurdle’ or benchmark in relation to the Performance Fee for the Investment Manager. The Performance Fee is subject to a High Water Mark which is the greater of the highest Value of the Portfolio as at the last day of any Performance Calculation Period and the gross proceeds raised under the Offer. See Section 10.1 for further details

That’s right folks, the hurdle to trigger 20% performance fees (plus GST of course) was… zero. It must be bittersweet for the fund’s hardy investors not to pay this fee when the reason was because WAM managed to produce negative returns.

Had the hardy investor dispensed with the services of the broker who put them in it for 1.25% (plus GST of course) and instead invested in AAA, the cash ETF then they would currently be sat on a return of 11%

Globally useless

WGB is benchmarked against the MSCI SMID index, and if you were to look at the fund’s monthly report you would think you had made a great choice in your adviser who tipped you into this.

However a quick look at how it performed against it benchmark would reveal 40% underperformance over its 7y life

I could go on, ok I will

And the flagship WAM fund:

WMX: fee harvester

If you choose to invest in WMX, then not only will you be paying away 1.25% (+GST) to your broker, you will be paying away 0.88% (+GST) to WAM and in the unlikely event they outperform you will be paying away 20% (+GST) to WAM again if they beat a combo of the asx300 and cash +1%.

This portfolio could be easily replicated with 60% VAS (fee 0.07%) and 40% VAF (fee 0.1%), so why are we about to pay 10x this to WAM?

No this is a genuine question - please do give me a reason??

Franking as a business model

The leader of WAM has been vocal in his support of the continuation of franking being refundable in cash. The question that should be asked of him should always be: would you have a business without franking?

Corporate governance as comedy

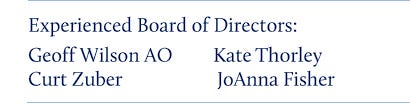

WAM list the board of WMX as a selling point in their prospectus:

Kate Thorley is on the board of every underperforming fund listed above. As an experienced board director whose responsibility it is to look after the interest of shareholders, what steps has she taken to remove the underperforming manager of each of these listed investment funds?

Outcomes

Here at taxloss towers, we are not ingenues. We understand that some folk want to make a buck, and it’s inconvenient to have to deal with people questioning why they should. But if in the future, a poor sap who has been tipped into this fund for a measly 1.25% (+GST) might want to sue the person who did that. After looking at WAM’s performance, surely having a reason handy would be prudent?

Toodles.