The ten-bag-a-seat Macquarie confessional is about to enter full swing and Cettire are up for an afternoon “fireside chat” slot. This naturally raises the question, what questions would I ask Cettire if I was at such a ghastly gathering? This obvious answer to that is the ones Cettire have never answered but we aren’t here to rehash old ground, even if it is really very important old ground. 1

Trying desperately to explain the rules of Conkers

The more interesting questions are to be asked of the the institutional investors in the stock - do you have a reasonable basis for your thesis? Buzzwords such as TAM, flywheel and moat go only so far in selling a story and people are rightly sceptical of luxury fashion having been solved by a company with no prior fashion experience in management. As fiduciaries of other people’s money one should hope so.

If the scale do turn

But in the estimation of a hair

Thou diest, and all thy goods are confiscate

There is one question upon which rests the ultimate fate of Cettire, and frames the debate around it. This is the question:

Has Cettire discovered a source of almost unlimited genuine luxury goods which it can secure at such a discount to retail without invoking sufficient ire from brands that it can pay to ship globally whilst paying the correct duties and sales taxes and providing sufficient customer service by accepting returns that it is compliant with local laws without incurring so many chargebacks from credit card schemes that would cut it off from payment rails whilst also solving marketing without the sole strategy to be the cheapest on google shopping such that if it wasn’t it would record zero sales?

If the reader requires a deep breath after that - they should. The marginal investor in Cettire is required to believe all of these things all at once, and any deviation from this absurd word salad means that Cettire diest, and all Cettire’s goods are confiscate.

Correlation as causation

How do we know this? Because it happened before! When Cettire allowed free returns from 23 Feb 2021 until sometime before Sept 2022 - margins fell off a cliff:

And between the end of May and early September 2022, this policy was reversed to not only charge a return fee, but also to introduce a policy of no refunds for duties (remember them?)

Cettire ‘explained’ this change with a buzzword salad at the FY22 results:

Meanwhile, as Cettire’s share price dropped from the dizzying heights of $4.75 in November 2021 to vomit inducing lows of 35c a mere nine months later, Cettire’s return rate had only increased from 25.7% in FY21 to 27.1% in FY22 - resilience this is not.

Trust in me, just in me

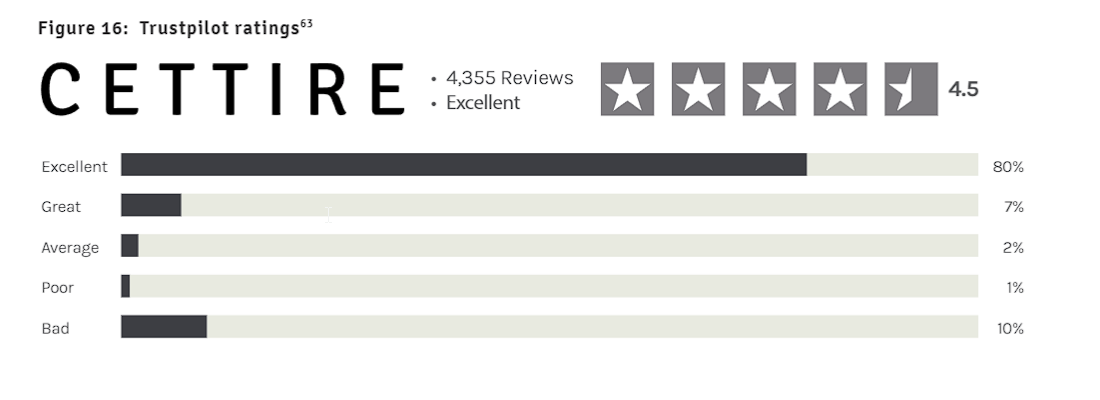

After the returns policy change which made duties (or estimated duties?) non-refundable, gross margins recovered along with the share price. But how did Cettire’s customers react? Using Trustpilot reviews as a very imprecise proxy - as Cettire did in their prospectus2 and until their 2021 AGM3 - Cettire’s rolling average of the last 500 reviews collapsed over this period from a high of 4.45 (out of 5) in March 2022 to a low of just 2.86 in December 2022

Before staging a statistically improbable recovery over the holiday period to poke back over 4 - we’ll leave it to the reader to draw their own conclusions as to the cause of that whilst keeping in mind Goodhart’s law.

Charging back

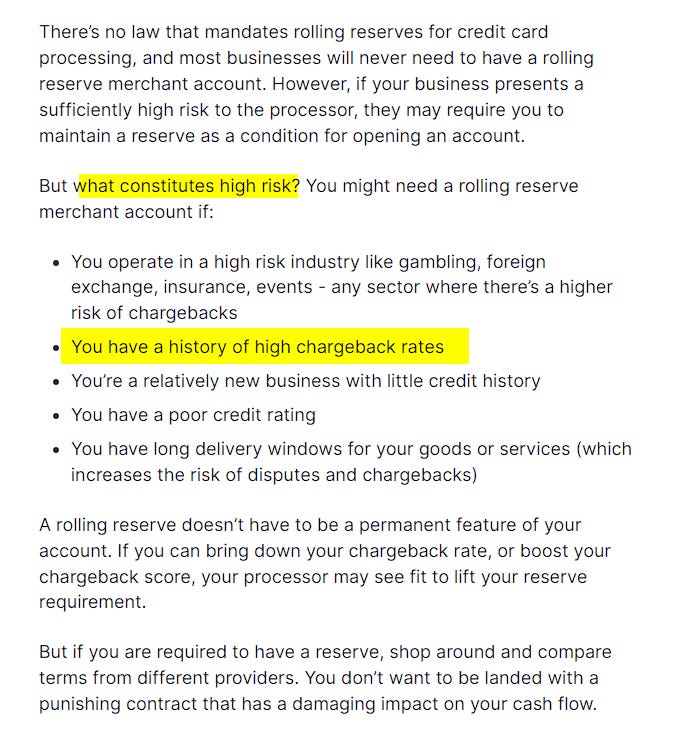

Now the big issue about implementing a returns policy that doesn’t match your customers’ expectations, and in the case of item not as described, not delivered or a return unprocessed doesn’t match consumer law in your major markets is that the customer avails themselves of their right to initiate a chargeback with their card issuer.

Now no payment processor wants a chargeback because they are horrendously expensive to deal with, which is why processors implement limits on a merchant’s chargeback rates before they are put on a remedial plan involving a rolling reserve or simply offboarded onto a high risk payments processor

They want how much??

One metric Cettire does provide in their accounts is the fees they pay for merchant processing, which should give us some idea of the relative risk that card schemes apply to Cettire as a business compared to other listed retailers that also disclose this figure.

A quick search for “merchant fees” on Bloomberg gives us Adairs, Siteminder and probably the closest analogue, Temple & Webster. These universally pay substantially under 1.5% in card fees.

Cettire on the other hand, has paid and continues to pay significantly higher fees:

These are numbers that gambling and adult sites would baulk at paying, which suggests that either our resident technology geniuses are significantly less savvy than TPW or alternatively that Cettire might be a business with a history of high chargebacks.

Pick your poison

Given that chargebacks generally occur as a last resort when a customer who is aware of this consumer protection has exhausted all other avenues of restitution, This exposes yet another fragility in the Cettire business model - that if their returns are too high, their margins collapse. If they strangle returns then customers initiate chargebacks. If customers initiate chargebacks, then credit card processors implement remedial actions - ultimately cutting off the merchant from the payment rails they depend upon.

Go to the top of the class and sharpen the rubbers

I can hear Regal piping up here, if not the daft kids at the back of the class - let’s call them Rat C*ck and the Number Go Up boys - if they have so many chargebacks how come their merchant fees have come down?

Well let’s do a little actual work shall we?

A little investigation of Cettire’s website suggests that after changing payment gateway in 2020 (as per prospectus)4, their merchant fees settled between 4-5% (as above). After Stripe was disabled a year or so ago, Adyen and Worldpay popped up as a technology on the Cettire website.

At the June 2023 results, we saw the accounts receivable increase significantly in a dropshipper that should have zero accounts receivable - without any clear explanation from the company.

Could it be that in the process of changing payment providers that a significantly larger rolling reserve was required? It would explain the non-trade receivable far better than a “simple” GST/VAT receivable as Regal - but crucially not the company itself - claim explains things.

Now it could be that any putative rolling reserve went away because Cettire cured any chargeback issues they had - if indeed they had any. But Cettire are still a ~$600m revenue company that is paying over triple what other companies are paying simply for the privilege of receiving payments by credit card, and 2024S1 was the lowest rate they have ever paid.

Between Scylla, Charybdis, several rocks and a few hard places

Is this a resilient business? Or is it a company that is walking a multi-faceted precipice between duties and sales tax compliance, returns and customer service issue, card scheme chargebacks and access to genuine product that even still only eke out a tiny margin even when every KPI trends north?

Perhaps this goes some way to responding to Adir Shiffman’s assertion that despite sales tax and duties non-compliance there was no individual “smoking gun” so far with Cettire.

There doesn’t need to be - Cettire is so fragile that it doesn’t even have a telephone number on its website to deal with its customers. It’s so fragile that it’s a $1.3bn business that’s paying high risk rates for card processing. It’s so fragile it re-registers for sales taxes in the Texas then denies it had anything to do with being exposed. It’s so fragile it uses the same auditing firm that ASIC are currently prosecuting over iSignthis’s comical 2018 audit. It’s so fragile that its earning calls require questions to be funnelled through investor relations that it shares with various penny specs and stock promotes.5

It doesn’t need a smoking gun, a gentle cigar-tinged zephyr is enough.

If you are looking for financial advice, please go and pay someone qualified. This is opinion only. Don’t deal in securities because of me, or for that matter anyone with a vested interest. Be smart. If you work for WAM, this could be the first time for you.