At the margin: Cettire's Taxing Issues

With apologies to Admiral Nelson: England expects that every man will pay his duty

For the purposes of this article I’m going to assume people are familiar with Cettire (ASX:CTT) and are aware of:

cheerleader-in-chief Bell Potter’s latest research note

the discussion between Adam Schwab, Adir Shiffman and occasional friend of the show Ruslan Kogan on the Contrarians podcast from December 2023 which expressed concerns over Cettire’s valuation, business model and accounting.

For the avoidance of doubt I am making no suggestion of any deliberate tax evasion by Cettire or any of its officers. Whilst every care has been taken to ensure accuracy I make no warranty that there are no errors. Nothing in this article is to be taken as advice or an inducement to deal in securities. I’m a trader and you should assume I have positions in stocks mentioned, and will actively deal in these stocks.

“Divisive”

Ever since the 2021 AFR ‘cloud of mystery’ article, Cettire has been a divisive but incredibly well performing stock. Regular large sell downs by management, curated conference calls, shocking online reviews and difficult to interpret disclosures have done little to discourage the sceptics but an ever increasing share price has brought rewards for fund managers such as WAM, Regal, Cat Rock and of course iSignThis baggies LHC.

February’s half year results were so well received CTT was propelled to a $1.8bn valuation putting it on the cusp of S&P/ASX200 entry, which prompted Nick Fabrio and I to cast a gimlet eye over the company and in the finest traditions of hotcopper, do our own due diligence to understand how Cettire has thrived whilst competitors Farfetch, Matchesfashion and YNAP are all in such strife.

With the USA representing the majority of net sales and being the engine room of Cettire’s growth, we decided to purchase some goods and have them delivered to the US to get a better understanding of the purchasing and returns experiences with Cettire.

The Lasso Way

In the company’s “response to media article”, a line jumped out:

Cettire believes that all applicable duties and other import charges are paid to the relevant authorities at the point of customs clearance. Goods are unable to clear customs unless the applicable duties are paid.

It’s unclear why Cettire used the word “believes” rather than “confirms”, given that as the importer of the products it is their responsibility to ensure this is the case. Johnny Shapiro also revealed in a recent podcast that he had directly asked whether duties were paid on the AFR’s specific order, so it’s also unclear why Cettire did not respond to confirm they had paid them.

This is all well and good, but in the last half Australia represented around 6.4% of net sales, so even in the event local customs compliance issues were widespread they were unlikely to be financially material to Cettire’s business model.

However, 59% of FY23 and 54% of H1 FY24 sales1 were in the USA which had much more potential to be material - both in terms of profit and licence to operate - so we hoped to confirm that the company was correctly paying duties there.

We were unable to confirm that duties were paid, in fact on our order they were most definitely not paid.

No Sales or Use Tax charged

However before getting to the duties, we were surprised not to be charged any sales tax on the order.

After the 2018 South Dakota vs Wayfair ruling, businesses selling more than a de minimis annual amount ($500k in Texas and California, as low as $100k in many other states) must register, collect from their customer, and pay state sales and local use taxes. In Texas this is a flat 8% for remote sellers - in California it’s between 7.25%-10.75% depending on which district you are shipping to. With FY2023 net US sales of over US$166m2, this threshold would have been reached in every major state in the US.

Our Texan basket:

Using a dummy Californian address also yielded no sales tax:

This was how the website appeared at the time we were researching Cettire until Cettire recently made changes - it’s not possible to say whether this has always been the case and no suggestion is made that this was deliberate.

It’s my Duty to report Duty unpaid

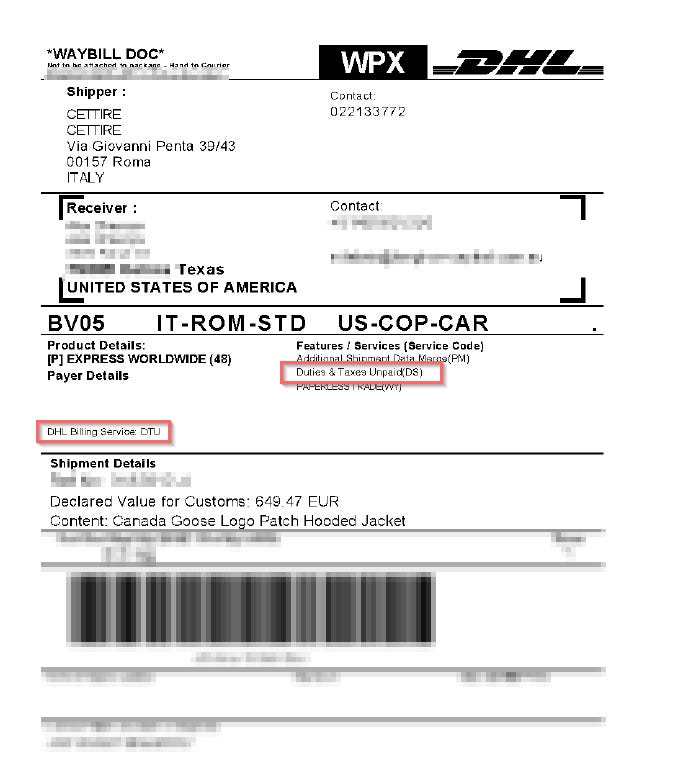

We were charged 16.5% “duties” by Cettire on our $1,016.48 purchase, amounting to US$167.72. However upon requesting the Waybill from the ever helpful DHL we discovered that the declared value for customs was €650, or about US$710 - below the de minimis threshold of $800 for duty, and as such no duty was paid by Cettire on this transaction. The consignment was also shipped DTU - “Duties and Taxes Unpaid” meaning any duties would fall upon the recipient to pay3.

Again, it’s not possible to conclude from a single order that under declaring the value for customs is widespread or that it is deliberate, and no suggestion is made to this effect.

Changes made to the ordering process and policies

After the ‘significant attention’ on Cettire on 19th March they announced changes at the checkout such that duties are no longer a separate line item and are included in the displayed price. It appears that changes to the checkout were tested on the live website because when the author checked on 11th March, sales taxes appeared on a Californian checkout - but calculated using the base price of the item pre-duties rather than on the landed price as it should have been.

As of 24 March, just as the company described the duties are now not separately listed and the sales tax is calculated using the correct method.

So compared to the end of February/early March, items purchased on Cettire from the US are now around 8% more expensive than before due to the estimated (why?4) sales tax charged, reducing the discount Cettire can offer relative to its competitors that have always charged sales taxes. As a company whose entire raison d’être is charging lower prices than its competitors, any effect on sales and margin will presumably be seen in Q4, since Q3 is almost over.

But where does the sales tax go?

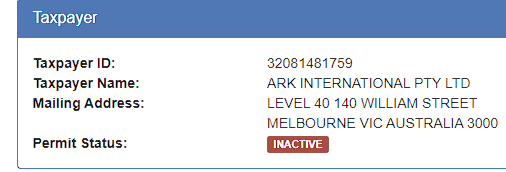

Cettire lists seven subsidiaries5 in its accounts, all containing “Cettire” or “Ark”. When searching the Texas Comptroller’s website for registered sales tax payers, there is no company listed with the name “Cettire”. Ark International Pty Ltd is listed, however it is marked as inactive.

Further enquiries with the Comptroller’s office reveal it was issued with a permit in October 2021, but is not in good standing in Texas with an “open collection” on the account.

Enquiries with the Californian authority CDTFA also failed to uncover an active use tax payer there - however it is possible that another company has been registered or that they are in error.

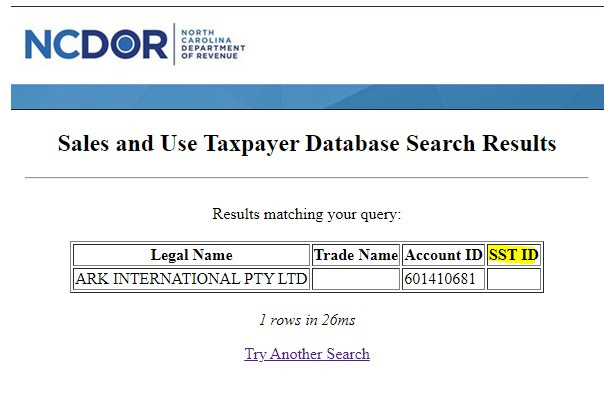

The Streamlined Sales Tax (SST) scheme covers 23 states and provides a single point of paying sales tax across these jurisdictions. Ark International is registered for sales tax in a member state (North Carolina) but if it is registered for the scheme then it hasn’t provided its details to NC.

Assuming Cettire are actually paying across sales tax to the relevant authorities - and no implication is made otherwise - then the means of how they are doing this is very unclear, especially in Texas.

A little analysis

Whilst it is not possible to draw a conclusion that from this one order that the underquoting of the value of goods for duty purposes that was evident in our order is either widespread or has been frequent, together with the orders cited in the recent AFR article it is equally difficult to conclude this is an isolated error.

It is however possible to analyse the size of the effect of the benefit that Cettire derived from our order in particular compared to if the correct taxes and duties had been applied.

Assuming:

Cettire’s H1 FY24 delivered margin of 23% of Sales Revenue6 (so including duties and sales tax charged) from the company presentation

Texas combined sales tax of 8%

Duties on jackets of 16.5%

that Cettire’s delivered margin includes sales taxes and duties being paid to the authorities (as it must be)

So in the singular case of our order, the effect is a near doubling of the delivered margin, and 20.5 absolute percentage points of EBITDA/EBIT/Pre-tax profit margin. This mistake created a significant benefit to margin relative to the correct treatment- and despite looking very hard it’s hard to find any examples of countervailing errors that have been to Cettire’s detriment. If you do have any examples, please do contact me here or on the bird app.

Don’t try this at home

Now it’s important not to get carried away by in some way using this 20.5% number to make swingeing assertions about the composition of Cettire’s margins, not only is it unclear how often this has happened but even if we wanted to work out the exposure in the unlikely event that this is a more frequent mistake, there are many things we have to guess in order to come to an estimate of erroneously gained margin:

the number of US orders that are over $800 and their average size to get to dutiable revenue

the average duty rate applicable to dutiable orders

the quantum of mistaken undervaluing of items, especially around the $800 mark below which taxes drop to zero

Separately for the treatment of sales taxes - average sales tax rates, and how often and for how long taxes have not been charged

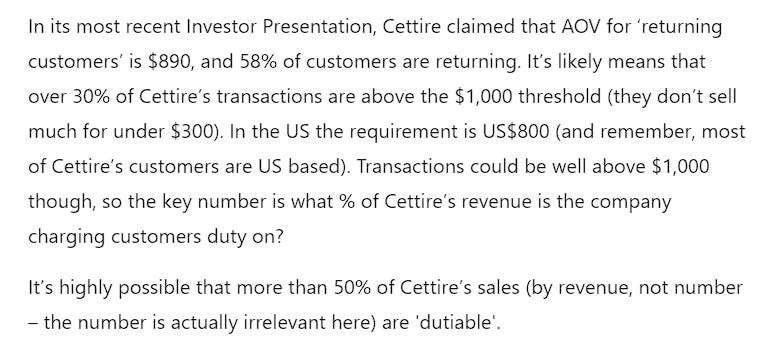

Adam Schwab had a guess at the dutiable revenue on his linkedin post - I can’t speak to its accuracy but it looks within the bounds of possibilities:

He also called out a rate of 5.63% for the average duty payable in the USA - however this appears to be the average of all goods, not clothing specifically. Using one’s trusty copy of the WTO World Tariff Profiles 2023 Edition, the average rate for clothing is in fact 11.7% - making it the highest dutied non-perishable category for the USA.

Using this average rate implies that as an order drops below $800 dutiable value, around $94 of duties evaporate.

Now I’m not going to take Adam’s number of 50% and apply it as dutiable US revenue and then multiply through by US sales of 54% and the plug in an assumed undervaluation % and come up with a potential benefit from mistakenly underdeclared shipments - because we don’t know if it’s systemic, even if we do know it has happened more than one time. We shouldn’t do this also because the numbers are far too uncertain to even make the calculation meaningful - Cettire has never quoted their dutiable revenue or any of these metrics we would need to make a good estimate.

However if you do take roughly 1/4 of global sales as US dutiable then that’s of the order of A$150m of revenue in the LTM. Cettire’s LTM pre tax profit is only $30m, so taking a 10% materiality threshold a $3m contribution would be material - requiring only a 2% benefit from “mistakes” to reach that threshold. This is an order of magnitude lower than the benefit from our order and therefore much more easily reached.

With sales taxes, the three states with the largest economies have average combined sales taxes in the 8-9% range so any issues with not paying them would be instantly material - but despite the question marks raised over the standing of their registrations there is no clear evidence of that as yet.

Looking ahead

The hurdles on the CFO’s 2021 LTI 2,500,000 $1.21 strike options have now been met so we await a notice to the ASX about their allotment. At a last price of $4.06 they’re worth over $7m, which whilst chump change to the founder will single-handedly make the CFO a rich man by the author’s more humble standards.

The financial effect from the changes made to the checkout, including charging sales taxes in the states which we previously identified as not having sales taxes at the checkout won’t be seen in the Q3 update - the changes went live on 19th March and with only 12d left in the quarter this will very much be a business as prior quarter. However any Q4 update on sales (which will benefit numerically from sales tax but with an unknown effect on number of sales and basket size) and margin (which will suffer from the larger divisor) will be fascinating to watch.

Final thoughts

It has been a lot of fun working with Nick and I look forward to doing it again soon - so many thanks to him for his enthusiasm and indefatigability.

The legendary Phil King of Regal was quoted in the Australian as saying he had “thoroughly investigated the latest round of claims around [CTT] but remains happy to be a long term investor.” However throughout this research, I’ve been struck by how hard it is to find solid detail on Cettire’s business model and how upon parsing recent statements from the company, the lack of plain definitive language in them means it has been impossible for me personally to gain enough comfort that the company is globally compliant with its duties and tax obligations. Perhaps if Mr King reads this then he might share some of his investigation!

I also hope the company heeds the advice of the Chanticleer column and uses this episode as an opportunity to improve disclosure and communication - after all a business model that requires total secrecy to succeed has a single point of failure.

PS: If any US people have shopped at Cettire in the last year or so would like to share experiences (good and bad!) and ideally their waybills and orders, please get in touch using this fancy button - or hit me up on the bird

PPS: What became of the order itself? Well we requested a return from Cettire customer services, but DHL said the paperwork wasn’t filed with them to request a pickup, so it would appear we are stuck with it with no refund. The email based customer service has not been particularly responsive - they haven’t even provided us with an invoice despite multiple requests - so hopefully there will be some cold nights in Texas to use the Canada Goose! With this level of customer service, if Cettire wasn’t the cheapest, why would you shop there?

&

Shopify offer a service to correctly calculate sales tax: https://www.shopify.com/tax as do many other providers. This is also true of duties, so it’s unclear why Cettire keep referring to “estimated” duties. The only variation I can think of is currency fluctuation, but this is unlikely to be even slightly significant.

Ark Technologies Pty Ltd; Ark International Pty Ltd; Cettire, Inc incorporated in Delaware; Cettire S.R.L (Italy); Cettire Limited (UK) - Dormant at companies house; Cettire HK Limited; Cettire (Shanghai) E-Commerce Co., Ltd.

Cettire defines “gross revenue” as “revenue net of GST/VAT/Sales Tax but before refunds to customers”, and it defines “sales revenue” as “gross revenues net of allowances and refunds to customers” - which I take to mean that sales revenue includes duties and taxes, as allowances aren’t defined by them. If my reading is incorrect I’ll happily update the post.

interesting article. i don't believe the 'ark international' you have found is related to ark technologies or cettire in anyway, there is a ark technologies annual report (one of top results after googling) and it doesn't mention it as a subsidiary anywhere there or in the cettire annual report.

my gut tells me there is a elaborate system here that only works where you have multiple, legally separate retailers, in different geographies, in your 'drop-shipping' network. it seems that they could be splitting transactions and recording the value cettire is paying to the 'middle' retailer and not the fee paid by the customer.

there are some highly elaborate legal ways you could pay tax on the price the retailer who sends the goods received from Cettire instead of the price charged on the website - my guess is this is what cettire is doing.

also your article today about the lack of registered businesses under Ark and Cettire is a bit off the mark - i know a lot of retailers that have subsidiaries in various jurisdictions whose names have nothing to do with the parent companies name. needs more digging than that.