Cettire's Unexplained Revenue

Following orders to find the source and Cettire's an agent, just ask management!

Straight from the gift horse’s mouth

Now we here at taxloss Towers remember trailing a little look at Julian’s gift horse’s toothipegs and we hate to disappoint our wise and curious readers. So let’s fix that with a bit of accounting wonkery, that will also hopefully aid Grant Thornton in its ongoing audit of Cettire.

Grant Thornton have consulted the people best placed to work out the Agent/Principal question under AASB15 and have decided that Cettire are Agent. Who did they consult? Well the CEO and the board it would appear!

Now for those that need a quick brush up on the specific accounting principle, it comes down to whether Cettire control the goods before they get to the customer, and whether they bear the responsibility for the acceptability of the goods to the customer1.

At the Macquarie conference when discussing returns, the CEO was quoted:

“The whole flow backwards, forwards and back again – there’s no human intervention for us … There’s not a single Cettire employee doing anything there. At scale this is hard to do globally.”

Whilst in the ASX response to that article the board signed off on the statement:

In Cettire’s business model, the supplier assumes the risk on a product return. Moreover, if a supplier became known as participating in non-genuine products, that supplier would risk severe reputational exposure in the supply chain.

Hard to find much nuance there, so agent it is then! But why are Cettire pushing back so hard when Julian says this will just increase their margins?

Metrics don’t reconcile to revenue - and all in one direction

In Cettire’s 1H21 presentation (hilariously titled “Project Coin Presentation” - he wasn’t wrong for the founder!), they helpfully provided a natty diagram to explain their revenue drivers:

Since Cettire stopped disclosing A and B soon after this presentation, our interest should focus on C x D - the number of orders times the average order value (AOV) is gross revenue.

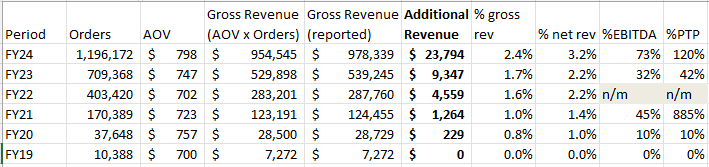

Or is it? In FY24 Cettire had 1,196,172 orders and an AOV of $798, giving gross revenue of $945.5m +/- $600k. However Cettire reported gross revenue of $978.3m - additional unexplained revenue of ~$24m.

Tracing this calculation back further, since FY19 (when both methods of calculating gross revenues agreed precisely), in each and every year there has been additional unexplained gross revenue beyond the number of orders multiplied by AOV.

And not by a little! Unexplained additional revenue amounted to 73% of “adjusted” EBITDA and more than the entire pre-tax profit in FY24.

Using half year numbers, we can back out an AOV for the 2H and we still get additional unexplained revenue in each period - strongly suggesting this is a source of revenue outside of product revenue.

Candidates for the revenue source

Cettire charges for returns, however since Gross Revenue is defined as prior to returns, presumably this charge accounted for as a reduction in the refund. In other words if someone buys a coat (or jumper!) for $1000, this would add $1000 to gross revenue and net revenue. If that person subsequently returns it incurring the $30 return fee and $88 ‘customs’ fee, then this would mean that net sales were $118 - the gross revenue is unaffected, whilst the returns ‘rate’ would be 88.2% rather than 100% (more on this later2).

So if it isn’t returns, then the only other candidates are sales taxes - which Cettire assures us are pass-through and also don’t count towards gross revenue - and our old friend, duties!

As the CFO told us at the FY24 earnings call (eventually!), duties aren’t like sales taxes, strongly implying that they were not pass through. Presumably this means that duties revenues are simply added to gross and net revenues whilst duties costs (if any!) fall under fulfilment costs, so duties revenues would add to product margin, but duties costs would only be reflected once we got to delivered margin.

Could it be that this unexplained revenue is duties revenue since it is treated differently to sales taxes and returns fees according to Timmeh?

Stripping back the line items

As a reminder, from the prospectus we learned that Product margin is sales less COGS and Delivered margin is Product margin less fulfilment costs - freight and duties presumably the vast majority of these, so to get a feel for how much duties costs were, we can look at the difference between product margin and delivered margin.

Or at least we could have, if Cettire hadn’t stopped disclosing its product margin (and therefore its fulfilment costs) after the 1H22 results!

However the trend was already clear with fulfilment costs having ballooned from 8% of sales at IPO to 16% at 1H22, and FY22 was the nadir (so far!) for Cettire, with the share price languishing below IPO price touching a low of 33c as it made $26m of pre tax losses. Something had to be done about these fulfilment costs!

Synthesising agent accounting disclosures with unexplained revenues

If Cettire is compelled to recognise revenue on an agent basis, the economic reality would be that Cettire is agent in the acquisition and on sending of the goods to the end customer, and provides ancillary services of paying for freight, collecting duties and paying them ‘when duty is dutiable’ in the fine words of the CFO.

The risk for Cettire is that this would make their fulfilment revenue and costs far more transparent, since revenue/commissions would be booked net, whilst ancillary revenues and costs would be booked separately.

So instead of:

with product margin and fulfilment revenues and costs subsumed, we might be presented with:

which would give us all a handle on how much of Cettire’s revenues and profits come from ‘ancillary’ sources such as duties and return fees - perhaps they would even be broken out in a note to the accounts to save us the hassle! We can dream!3

Crucially, such a revision to revenue recognition would also apply to FY23 and a restatement on a comparable basis would be required, covering a period in which scrutiny on Cettire was much lower, and checkouts added duties and sales taxes (if any!) at the end.

Such an increase in disclosure wouldn’t only make an investor’s job easier, but presumably also the US customs agency CBP in identifying if Cettire/Ark Technologies/Ark International have been compliant, or even transacting in the case of Ark International.

Margins calling

As Cettire pointed out in their FY24 presentation, we’ve been here before! From FY22 to FY23, Cettire miraculously increased delivered/gross margins from 18% to 23% whilst cutting marketing expense from 21% to 9% driving a 17% turnaround in operating margins to…. a slightly disappointing 7% in 1H23, a figure which has not been reached since - with 4%, 6% and a big fat zero in the last half.

In 2H24 - a period which included only one quarter in which the duties-inclusive checkout was active, CAC exploded to $145, the highest it has ever been - touching $160 in Q4 according to Julian. Now it’s understandable that some of this might be due to the “promotional” environment the company has called out, however the effect of increased prices on CAC via Cettire’s major acquisition channel - Google Shopping - should not be discounted. Make no mistake, Cettire’s CAC is now structurally higher due to the change - as predicted all those moons ago. Reducing paid acquisition costs in FY25 is a much harder lever to pull than in FY23 when starting from 11% rather than 21%, whilst Cettire churned 64% of its customer base in FY24.

This means that holding churn constant and generously using the FY CAC of $130, Cettire needs to spend $58m just on paid acquisition costs to stand still, let alone generate the 20% revenue growth the market is still looking for.

However the most concerning thing for the bulls has to be that delivered margins also collapsed, when as an agent Cettire had no reason to cut their commissions to deliver unprofitable top line growth.

The true gift horse

With all sensible analysts having downgraded Cettire, the accounts still not signed off by Grant Thornton and a second auditor having a looky-loo, if the best bull thesis is that the founder used less than 5% of the cash he’s made from selling stock in this terminally low margin, precarious business to generate a short squeeze and retail frenzy - then maybe it’s time for the more sensible longs to accept the gift horse the founder has so generously given them and take advantage of the liquidity.

Neigh!

A short catch up

After raising the collapsed soufflé of as-yet-still-unaudited Cettire’s share price for the third time since the June profit warning, it would be churlish not to doff one’s cap at the current success of the apparently well planned squeeze/ramp even if it might have been at best questionable in its legality - but a rally from a low of $1.02 to a high of $1.80 is definitely a reason to be cheerful for the bulls, gadflies and baggies who are long.

So consider the cap doffed:

One teensy issue with propping up the stock with some of the money that the founder has extracted from the market through his regular and eye-wateringly large sell downs is that if by buying he can ramp the stock 75%, presumably this now means he can never sell a meaningful sum without causing a similarly precipitous collapse in his paper worth - meaning without a sustained return to a valuation significantly higher than his purchases, will he still view the advice he’s received about how to get the stock price up seem so smart if he has to keep feeding coins into the meter to keep the show running?

bit more complex but read page 31, B37 of the standard:

https://www.aasb.gov.au/admin/file/content105/c9/AASB15_12-14_FP_COMPdec16_01-18.pdf

not in this post, but later. Maybe a review of the unaudited accounts before we get the full fat version or a qualified opinion?

Yes I’m dreaming of readable accounts that give clear disclosure of key matters of interest to their users. Crazy I know.