Joe Aston had a good crack at writing about one of the most difficult subjects in Aussie finance to keep simple. No, not WAM’s portfolio managers - they’re already simple! 🥁

What is the performance of Wilson Asset Management’s LICs?

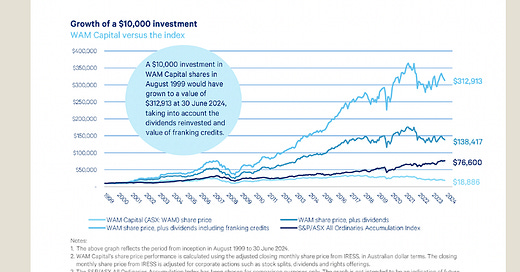

It’s a question that even WAM struggle to answer themselves judging by the panoply of figures that are quoted in their literature, but here we’re going to focus on the chart in Joe’s article:

Not only is this chart included in the 2024 annual report, but as at pixel time it emblazoned across the WAM Capital website making it a current investment promotion. Not only is Joe correct that that basis on which this return was quoted entirely unrealistic, the returns are entirely fictional, misleading and based on a data error.

Recreating WAM’s calculations - not simple

Starting with the simplest calculation - the share price return excluding dividends, WAM claim that $10,000 invested at inception was worth $18,886 in June 2024.

Since WAM floated at $1 in 1999, and the current share price is $1.43, prima facie we should expect our 10,000 shares we acquired back when Pearl Jam were topping the charts with “Last Kiss” should be worth $14,300.

The footnotes to the chart say that returns were calculated using the adjusted price:

The closing monthly share price from IRESS is adjusted for corporate actions such as stock splits, dividends and rights offerings

Using IRESS’s time series function to go all the way back to 1999 (coincidentally also when IRESS’s interface was last classified as “modern”) we can see an adjustment factor of 0.7572.

An adjustment factor is what you multiply the price you paid by to get the “true” return, so in this case the $10k you put up in 1999 actually bought the shares at 75.72c instead of $1 for the purposes of calculating returns.

So the price return has been calculated as:

Great success! However this is IRESS we are talking about, so it’s worth double checking that these adjustments are accurate.

Check your workings? Not WAM!

Drilling down to find when these adjustments occurred, we find that it corresponds to the ex date of only three of the four 1 for 1 option bonus issues that WAM undertook between 2001 and 2012. But these were bonus option issues, so how on earth would this result in such a huge adjustment?

Since IRESS appears to contain no record of these events, we fall back to the dead embrace of the Borg hive mind’s CACS function which shows that no adjustments were made at all for these transactions.

Looking at the share price moves on the ex date, this certainly appears to be much closer to reality than the ‘boost’ provided by the IRESS adjustments:

If the issues had been a dividend rather than a way for WAM to utilise a discount and the franking credits1 that shareholders’ funds had already generated to incentivise people to double the funds in Geoff’s fee generating pot, it would be simple.

But in order to work out the proper adjustment for these bonus issues, we need to go back to the original question - what is $10,000 invested at inception worth?

The investor here isn’t adding funds, they are drawing income or reinvesting it. So they can’t take up the option, they only have the $10,000 they started with. They could potentially sell their holding to fund the exercise of the option, however this would create settlement delays and lags and would be impossible to adjust for, and isn’t in the spirit of “what is my $10,000 worth now?”. A couple of these options were traded, so they may have been sold for value - but no pricing record is available and the difference between the strike and the stock price is small anyway, nothing even vaguely approaching the 15% and 12% boosts that WAM’s performance calculations received from IRESS’s adjustment.

So IRESS is flat out wrong, and therefore so is WAM’s calculation - in a big way and in it’s own favour (again).

What are the real numbers?

Try as I might, I can’t recreate the dividends reinvested numbers on WAM’s chart using IRESS data - if WAM were willing to share publicly their workings, perhaps we could identify the error and correct it. The closest I came was when I tried to get inside the mind of the poor WAM worker who has to battle through an IRESS pro interface and spreadsheet so that they can keep showing the General in the bunker the Right Numbers - so I started making deliberate stupid mistakes, like triple counting by adjusting dividends, number of shares AND share prices for the adjustment factor and got close. But no luck. Maybe something to do with DRP discounts?

But there are several functions on a Bloomberg Terminal that will do this for you automatically - TRA, COMP, HFA - so here are those numbers, together with my own calculation from WAM’s FY “investment portfolio returns” of what the naked performance translates to.

WAM’s investment portfolio performance doesn’t take into account franking credits paid out - it’s simply the time weighted return of the investment portfolio pre-taxes, pre-expenses and ignoring dilution, and using the table in the annual report, $10,000 would translate to $354,616 - which is pretty stellar. However due to the fees, expenses, dilution and tax leakage along the way, someone who owned the actual product available to them and dutifully reinvested their net dividends would have $84,593 after 25 years2. That converts the ~15%pa that WAM claims to have generated back to a much more modest ~9% - or put another way, on average 6% per year for 25 years of WAM’s performance (with the investor’s money!) has been lost to dilution, tax leakage, management fees, performance fees and expenses.

This return however is still more than the All Ords returned over the period and stands on its own as a decent record, even if the majority of the outperformance occurred when the fund was small, which brings us to:

The real outperformer - Shares on Issue

Wilsons are selling WMX and LICs generally of having the advantage of a “fixed pool of capital”. But that is only true in the sense that the punter has no way of extracting the capital from the company, it does not in any way mean that the company will not ratchet up the fee paying pool of capital beyond anything initially contemplated given the sniff of a chance.

WAM IPOd with 20m shares on issue. At the last count, there are now 1120m shares outstanding. That’s a compound ‘return’ of 17% per year increase, and each and every one of those shares has paid capital into the company that WAM now charge fees on. Now that’s real compounding!

Apportioning blame

It should come as no surprise to anyone that IRESS data is sometimes screwy - no data provider is fully immune. However when that data is about your own fund, that’s no excuse. It should have been self-evident to anyone even vaguely numerate that $10,000 did not turn into $313k under WAM’s stewardship - and that given WAM’s propensity for presenting unachievable numbers in large print, it’s also hard to write this off as a accident.

WAM are using Bloomberg to value their WMX portfolio according to the prospectus, so from now on there is no excuse for hand calculating returns in Excel to produce a my-first-chart in an annual report.

If Wilson Asset Management wanted to show that they are committed to transparently and fairly reporting their performance, they should withdraw the chart from the website and replace it with an accurate, up to date version with a note explaining that their previous report was incorrect, issue an update to the annual report and call in an independent performance analyst to review their disclosures.

They should do that, but what are the odds?

Whither WMX?

ASIC should put an interim stop order on the prospectus, and require WMX to issue a clarifying statement that anywhere they refer to “Investment portfolio performance” they also include in equal size lettering to the numbers a statement to the effect

“This is not the return that was achieved by a shareholder, fees, expenses and tax leakage are fundamental components of your investment return in a Listed Investment Company.”

And require that any time one of these theoretical, fictional returns are used in an investment promotion or prospectus have the true, net Total Shareholder Returns included alongside in at least equal size print.

Words of wisdom - from a regulator???

The UK’s financial regulator (FSA as was, now the FCA) in 2012 published the somewhat drily titled Financial Promotions, Fund Performance and Image Advertising guidance, which includes the following, surprisingly lyrical passage:

Financial promotions – a window into the culture of a firm

The content of a shop window not only tells you about the goods for sale; it speaks volumes about its business in its first contact with the consumer. Similarly, an advert’s content can offer strong clues as to how fairly your firm treats your customers. Attractive headline rates of return that only a small minority of customers can obtain; or important information relegated to the ‘small print’ (typically below the ‘call to action’, encouraging customers to contact the firm) are not usually consistent with a culture of treating customers fairly, as well as failing to be fair, clear and not misleading.

Similarly, if a firm repeatedly issues non-compliant adverts, this may well indicate that their systems and controls lack robustness.

Financial promotions are, by definition, in the public domain. However, as is well-known, and unlike some other regulators around the world, we do not pre-vet or approve promotions. So, even though non-compliant promotions are in circulation, this does not exonerate other firms from seeking to comply.

On that test (and several others)3, I think it is clear the WAM is failing to show that it has a culture that is committed to being fair, clear and not misleading - irrespective of what others do.

For those with a terminal: WAM AU Equity TRA <GO>

Settings - 10,000 shares

Buy Date - 8/12/1999

Sell Date - 06/28/2024

Value Type - Price

Period - Daily

This will set the buy price to 0.96 - which can’t be changed to the $1 float price. However this just means that you paid $9,600 instead of $10,000 for the shares, and you can deduct $400 from the end return without worrying too much.

You should end up with this result:

Therefore adding back the $10k invested (less the $400 differential in initial price) you get $84,593, to a spurious level of accuracy.

Factset's total returns with reinvestment/compounding from 13th August 1999 gets you about 12.5x

Putting it through Sharesight on the day of IPO at $1 and clicking on DRP you end with $5.43, an annual rate of 6.8%

https://www.sharesight.com/