The WAM Income Maximiser (WMX) books closed on Friday 11th April and the market waited with baited breath for the usual flurry of ASX announcements from the WAM stable of donkeys Listed Investment Companies braying that the IPO had been oversubscribed.

You say it best

However at pixel time nearly two weeks later, no announcements relating to WMX have been made at all despite shares hitting accounts last week!

In fact the only source of information on how much of the $510m targeted was actually raised was when the AFR’s Street Talk column picked up the phone and called the man who knows, Geoff Wilson himself.

It turns out that despite a cast of thousands of brokers (ok, eight) who were being paid illegal stamping ‘discretionary’ fees if they raised more than $15m, a $180m “priority” offer to anyone on their mailing list1 or anyone who has got an elderly relative with a warm pocket, Geoff banging the drum on the bird and a “wonderful turnout” at the coffee and biscuits roadshow - WAM managed to scrape from the >$30m they had at launch to a frankly paltry “roughly” $150m.

This means that in the previous week, WAM funds have paid out more in cash divis ($180m) than all of that drove of brokers managed to raise in a month! And that’s before Geoff’s franking!

Hide, no hair

Now there are those that would have pulled the IPO entirely, perhaps blaming market conditions for the lacklustre fund raise and saying they will be back in the future with an improved, more reasonably priced product when the market demand becomes apparent. However Geoff didn’t get to be the sole proprietor of a company that manages $5.5bn of captive capital by lacking confidence, ebullience or a solid brass neck, so naturally he was shamelessly upbeat calling it a "solid start”.

But Geoff doesn’t even try to disguise that he wants a yard plus in this fund, and given the history of WAM who would bet against him getting it! However, it’s worth examining how funds like WAM got there: it wasn’t through investment performance.

Monetising your franking for their marketing

Whilst it is true that WAM only raised $20m at IPO in 1999, it did so with 1:1 attaching options, and it issued 1:1 bonus options in 2001, 2003 and 2006 such that by 2007 it had over 100m shares on issue.

A 2012 1:1 option issue was swiftly followed by two more placements in a year resulting in SOI topping 340m by 2014, and ongoing placements and a ~10% dividend reinvestment rate have lifted the count to 1120m today.

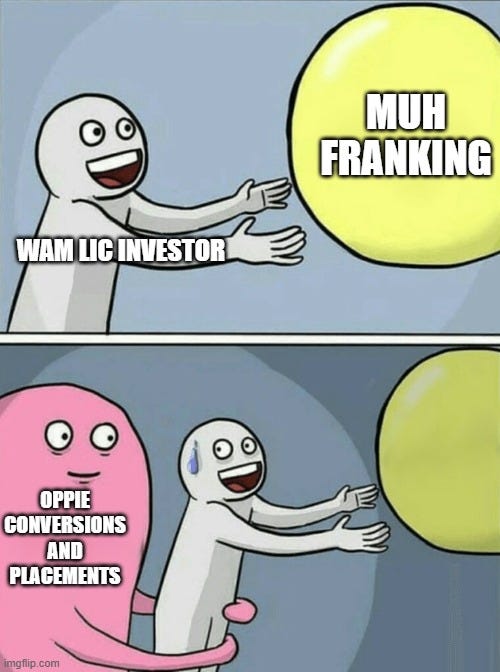

Now Geoff trumpets franked dividends as a key advantage of the LIC structure, even though a large part of the franking only represents tax paid by the LIC that wouldn’t be paid at all by a trust structure. But each time the share count was doubled by an option issue or a placement, the franking balance representing the tax that had been paid by extant shareholders was now shared by the new shares that hadn’t earned it, whilst those who didn’t take up their options had their share of the balance diluted by the 17% per annum compound increase in the share count that WAM has displayed.

Lessons learned

So what to learn from this? Well whilst WAM might promote the “fixed” pool of capital as a benefit, this benefit accrues to WAM alone. The pool is in no way fixed, it’s more like a ratchet - upward only.

If you are a current shareholder in WMX, then Geoff has said he wants to at least 7x the size of the fund. That means that even if all goes swimmingly, a significant part of your investment return that Geoff plays up will be not be enjoyed by you, but by whoever takes the next placement or converts an option. Be wary before the stock goes ex-div!

What of the actual fund??

Plenty of pixels have been spilt in these pages on WAM’s shortcomings managing equities, but at taxloss Towers our bugbear wasn’t so much whether they were any good but that they claim to be better than they are. In promoting WMX with its basic 60:40 strategy as an alternative to hybrids, WAM inadvertently revealed precisely how ill-equipped they are to manage a bond portfolio.

WAM set their performance fee hurdle the Bloomberg Bank Bill Index + 1% which means they are benchmarked to a index with a duration of close to zero - which is lucky because Matthew Haupt and Geoff both say that the core will be floating rate Tier 2 subordinated bank debt.

Now for those who are bond tourists (like WAM) this is what a bank’s capital stack looks like with risk increasing left-to-right (and equity off screen, torching Philip King’s short book)

Return-free Risk

With the Bank Bill index yielding 4.02% (since it is based on one month forward rates, not cash) the current yield premium for sub debt is about 98bps - about the same as the GST-inclusive management fee! So the debt element of the portfolio is getting the risks of subordinated bonds, for the return of a government guaranteed bank account. Return-free risk for thee, fees for mee!

And yet in order to reap those lovely performance fees, WAM will have to produce over another 1%pa return on top. This return will have to come from yet more risk, whether it is from credit risk in buying the dodgiest regional bank debt, taking on duration risk by buying longer term fixed interest, equity risk by allocating more of the capital away from from the benchmark of 40% debt into higher risk equities or most likely a combination of all three.

Indeed in Geoff’s interview with Alan Kohler, he points out

We could be 70, 80 per cent of [debt] and only 20 or 30 per cent in equity, or we could be 70, 80 per cent equities and less in the debt. So we have those levers we can pull, which really gives us a lot of flexibility.

Show me the incentive, I’ll show you the outcome…

Echos of eras past

In researching WAM for these poasts, the over-riding impression is one of times past - of the smooth-talking salesman who is your best mate and agrees with you that it was so much better in the good ol’ days then charges you like a wounded bull.

There’s something Mesozoic about trying to find loopholes to pay brokers commissions for selling your product after such payments were explicitly banned due the unavoidable conflicts of interest they create, and it takes a special sort to see that conflict and do it anyway!

There’s something almost nostalgic about quoting utterly hypothetical, unverifiable performance figures before charges, taxes, dilution and presumably soon losses in large print in fund literature whilst the actual returns endured by their investors are a mere fraction of the Large Number.

There’s something from the analogue age in charging 1 and 20 for return free risk when you can buy the same beta for less than 30bps in an ETF where the franking isn’t generated by paying 30% tax on income and capital gains inside the LIC. Though perhaps the ATO should have a “Geoff Wilson Wing” for all the interest-free loans his LICs’ investors have provided them with over the years by paying tax in the fund one year and waiting until the next to reclaim it!

You gotta LIC it, before they kick it

WAM is the embodiment of what is wrong with the LIC industry - arrogant2 in assuming ASIC will continue to sleep whilst their performance figures are shown to be bunk, complacent in thinking assuming their marketing machine would churn out more cash despite a substandard product, lazy and reflexive in their analysis of things they clearly know little about - and whilst possessing a certain folksy old-world charm, ultimately asset-gathering rent-seekers3.

Otherwise reputable people seem to stick up for WAM because their proprietor has a crack at the likes of Nick Bolton, so surely WAM are the good guys? An alternative hypothesis is that WAM doesn’t want others pissing in their pot giving LICs an even worse name.

But are WAM good investors? Well if they were, they wouldn’t need to hide behind dodgy performance disclosure and poorly formatted Excel bar charts that obfuscate - they’d just publish the real post tax, post costs, post dilution numbers and let them do the talking. But much like WAM’s silence on how much WMX raised - crickets.

If probably ultimately correct

If franking credits weren’t refundable then the tax leakage from the LIC structure would reach untenable proportions even for tax-free accounts like Geoff’s grey army. The 2018-19 campaign against Labor’s manifesto wasn’t entirely altruistic on this basis - it was existential.